In 2024, many regions reported a year-over-year growth ranging between 5% to 10%. Major apparel manufacturing hubs such as Bangladesh, Vietnam, and India have experienced significant export growth, attributed to their emphasis on cost competitiveness, automation, and compliance.

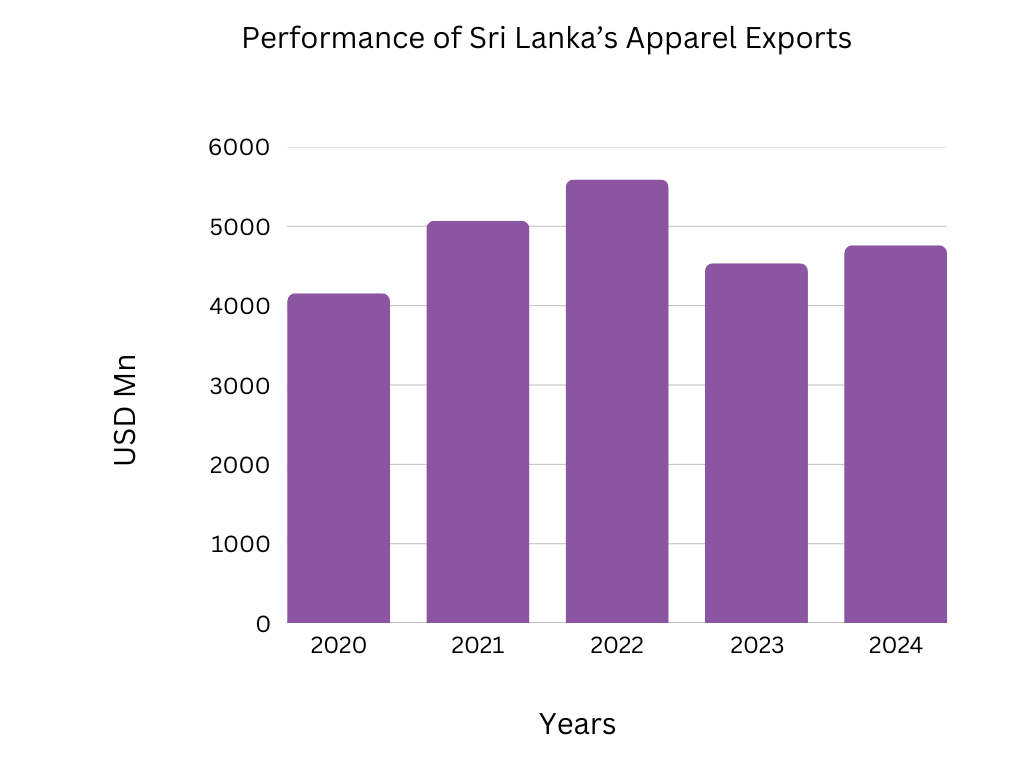

Sri Lanka, known for its exceptional apparel manufacturing, has experienced a varied set of outcomes. In 2024, garment exports amounted to 4,761.02 million USD, an increase from 4,535.45 million USD in 2023.

Consumer preferences are increasingly leaning towards sustainable and ethically sourced apparel, especially in the European Union and the United Kingdom. Sri Lanka’s commitment to sustainable and ethically manufactured apparel aligns with this global trend. However, there is a pressing need to amplify these efforts to meet international standards and consumer expectations.

Geopolitical and economic factors have also played a significant role. The European Union’s market decline reflects broader economic stagnation and the repercussions of the energy crisis in Europe. Conversely, Asia-Pacific markets, notably China and India, are expanding, presenting potential opportunities for Sri Lankan exporters, provided that better market access can be secured.

Challenges Facing Sri Lanka’s Apparel Industry:

• Pricing Pressures: Data indicates that volume growth is outpacing value, suggesting downward pressure on pricing, which is unfavourable for Sri Lankan exporters.

• Currency Fluctuations: Over the past two years, the Sri Lankan Rupee (LKR) has strengthened significantly against the US Dollar (USD), leading to a more than 35% increase in wage costs in USD terms. In contrast, currencies of competitor nations have weakened against the USD, rendering Sri Lanka’s exports less price-competitive.

• Intense Regional Competition: Countries like Bangladesh and Vietnam offer lower production costs and enjoy better market access to both the EU and the UK, intensifying competition.

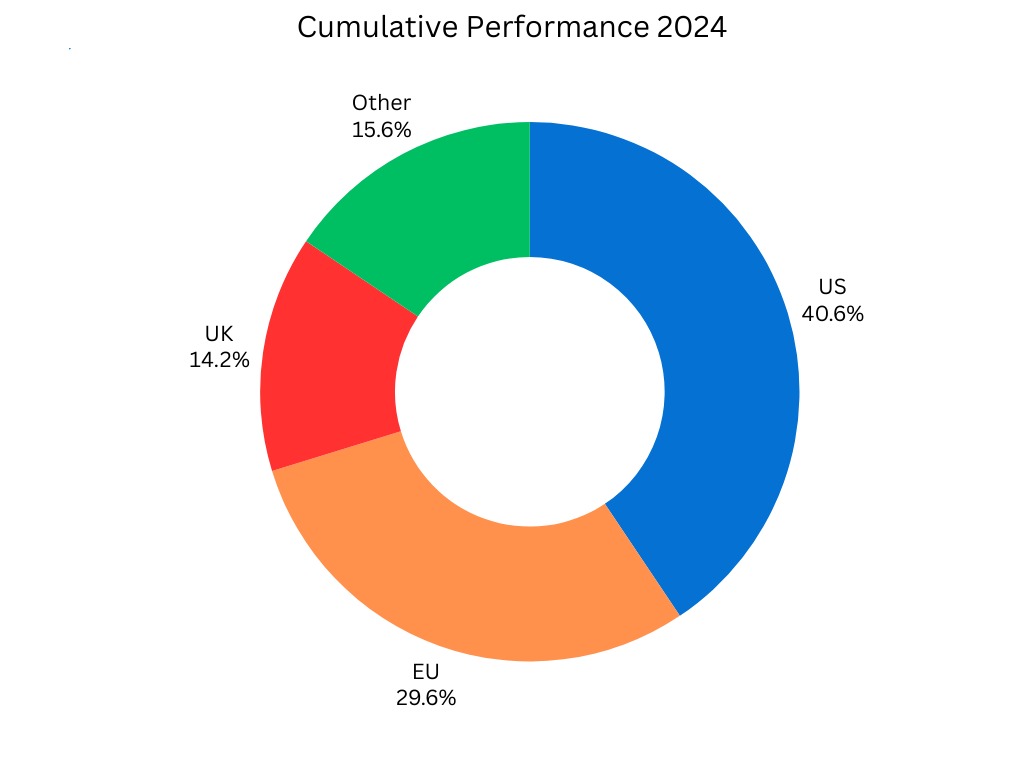

• Market Dependency: A heavy reliance on traditional markets such as the USA and EU exposes Sri Lanka to demand fluctuations in these regions.

Opportunities for Growth:

• Market Diversification: Exploring non-traditional markets like Japan, Australia, South Korea, India, and China can reduce overreliance on Western markets and open new avenues for growth.

• Sustainability Credentials: Investing in certifications like Fair Trade, carbon neutrality, and circular fashion can attract global buyers who prioritise ethical sourcing, positioning Sri Lanka as a premium supplier.

• Trade Negotiations: Securing better market access through Free Trade Agreements can level the playing field with competitor nations, facilitating entry into new markets beyond traditional ones.

Strategic Recommendations:

1. Enhance Market Diversification: By focusing on emerging markets, Sri Lanka can mitigate risks associated with dependence on traditional markets and tap into new consumer bases.

2. Invest in Sustainability: Promoting and obtaining relevant certifications will not only meet global standards but also enhance the country’s reputation as an ethical apparel producer.

3. Improve Cost Competitiveness: Addressing logistical inefficiencies and reducing production costs are essential to compete effectively with regional players like Bangladesh and Vietnam.

4. Strengthen Bilateral Relations: Negotiating favourable trade agreements with key markets can alleviate tariff disadvantages. Leveraging the relationship with India to remove the 8 million piece quota on apparel exports could be particularly beneficial.

In conclusion, while Sri Lanka’s apparel exports have shown signs of recovery, challenges remain. Strategic shifts focusing on sustainability, market diversification, and cost efficiency are imperative to enhance the industry’s competitiveness on the global stage.