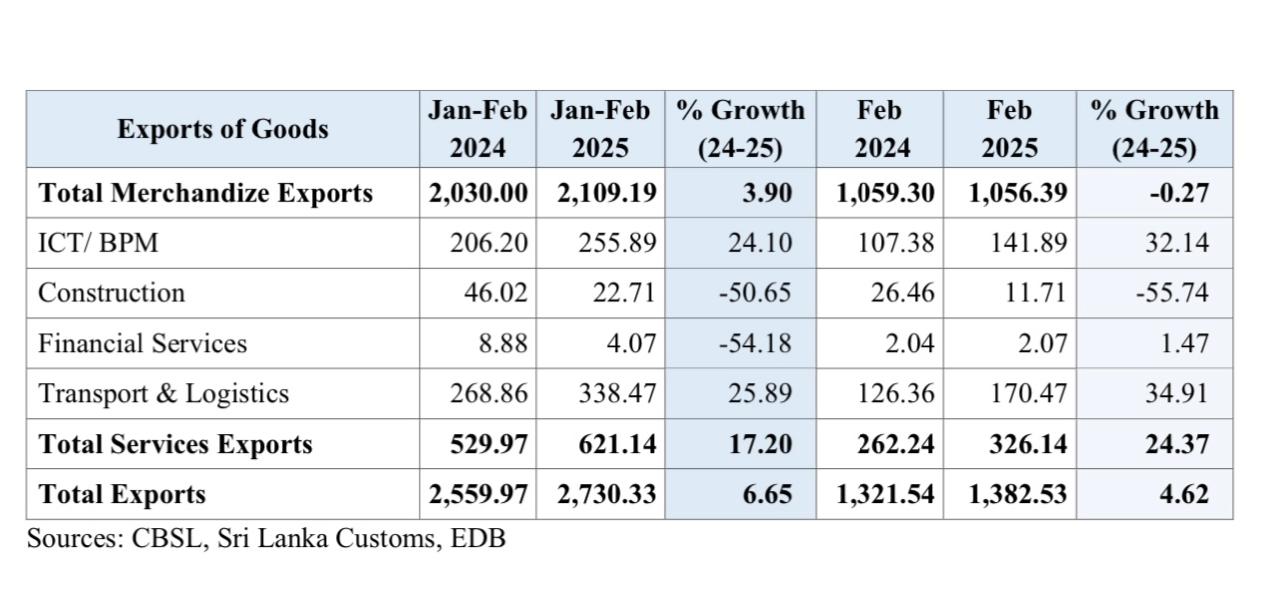

Sri Lanka’s export sector maintained a positive trajectory in February 2025, with total exports—including both merchandise and services—rising to US$ 1,382.53 million, reflecting a 4.62% year-on-year (YoY) increase compared to February 2024. Additionally, exports recorded a 2.58% month-on-month (MoM) increase from January 2025.

Merchandise and Services Exports Overview

According to provisional data from Sri Lanka Customs and estimated figures for Gems & Jewellery and Petroleum Products, merchandise exports were valued at US$ 1,056.39 million in February 2025. Meanwhile, services exports surged by 24.37% YoY, reaching US$ 326.14 million for the month.

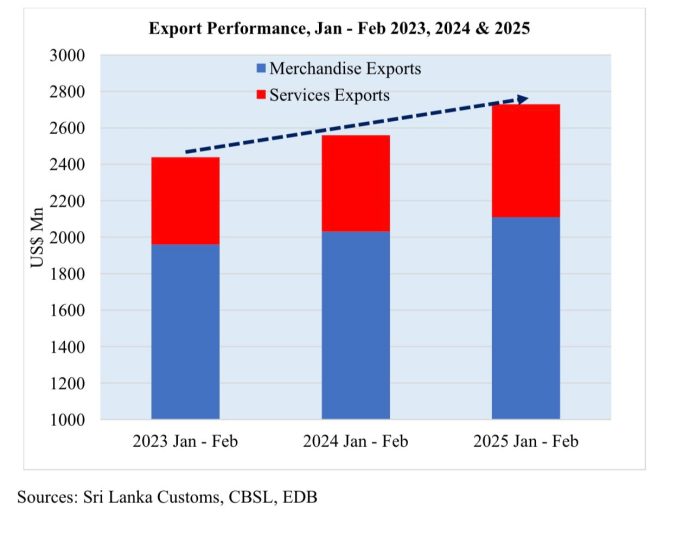

For the January–February 2025 period, cumulative total exports stood at US$ 2,730.33 million, marking a 6.65% growth compared to the same period in 2024. Merchandise exports increased by 3.9% to US$ 2,109.19 million, while services exports showed an impressive 17.2% increase, reaching US$ 621.14 million.

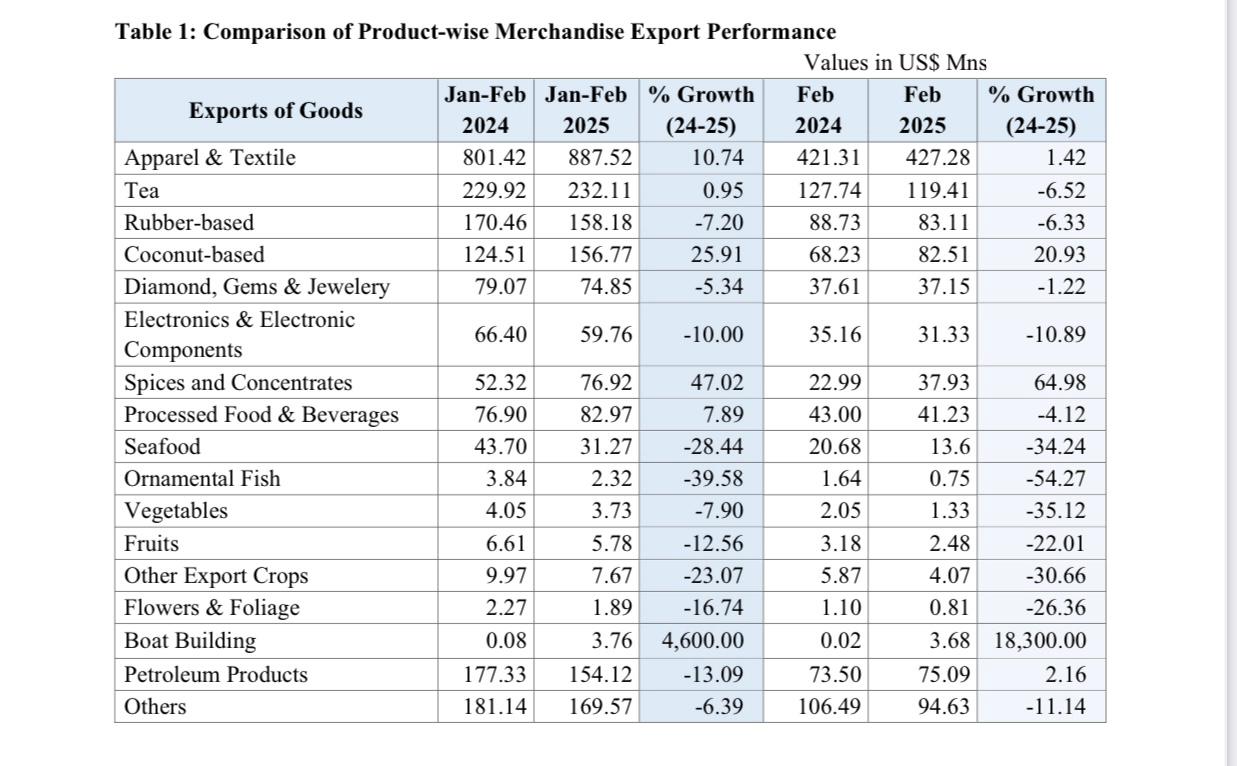

Key Sectors Driving Export Growth in February 2025

Several product and service categories demonstrated strong performance:

• Apparel & Textile: Increased by 1.42% YoY to US$ 427.28 million.

• Coconut-Based Products: Showed significant growth (20.93% YoY), with Coconut Oil (+57.42%), Coconut Milk Powder (+77.88%), and Coconut Cream (+53.13%) contributing notably.

• Spices and Essential Oils: Export earnings soared by 64.98% YoY, driven by Pepper (+243.13%), Cinnamon (+19.32%), and Cloves (+309.56%).

• Boat Building: Recorded an 18,300% growth, reaching US$ 3.68 million.

• ICT Exports: Estimated to increase by 32.14%, amounting to US$ 141.89 million.

• Logistics & Transport Services: Expected to grow by 34.91%, reaching US$ 170.47 million.

Declining Sectors in February 2025

Despite overall growth, some sectors experienced a downturn:

• Tea Exports: Declined by 6.52% YoY to US$ 119.41 million, with bulk tea exports falling by 22.96%.

• Rubber & Rubber Finished Products: Dropped 6.33% YoY to US$ 83.11 million, mainly due to decreased demand for Pneumatic & Retreated Rubber Tyres & Tubes (-21.38%).

• Food & Beverages: Fell by 4.12% YoY to US$ 41.23 million, with Animal Feed exports decreasing by 23.57%.

• Seafood Exports: Declined by 34.24%, mainly due to reduced demand for Fresh Fish (-63.75%) and Shrimps (-81.42%).

• Electrical & Electronics Components: Dropped by 10.89% YoY, with Insulated Wires & Cables (-15.93%) and Printed Circuits (-90.53%) performing poorly.

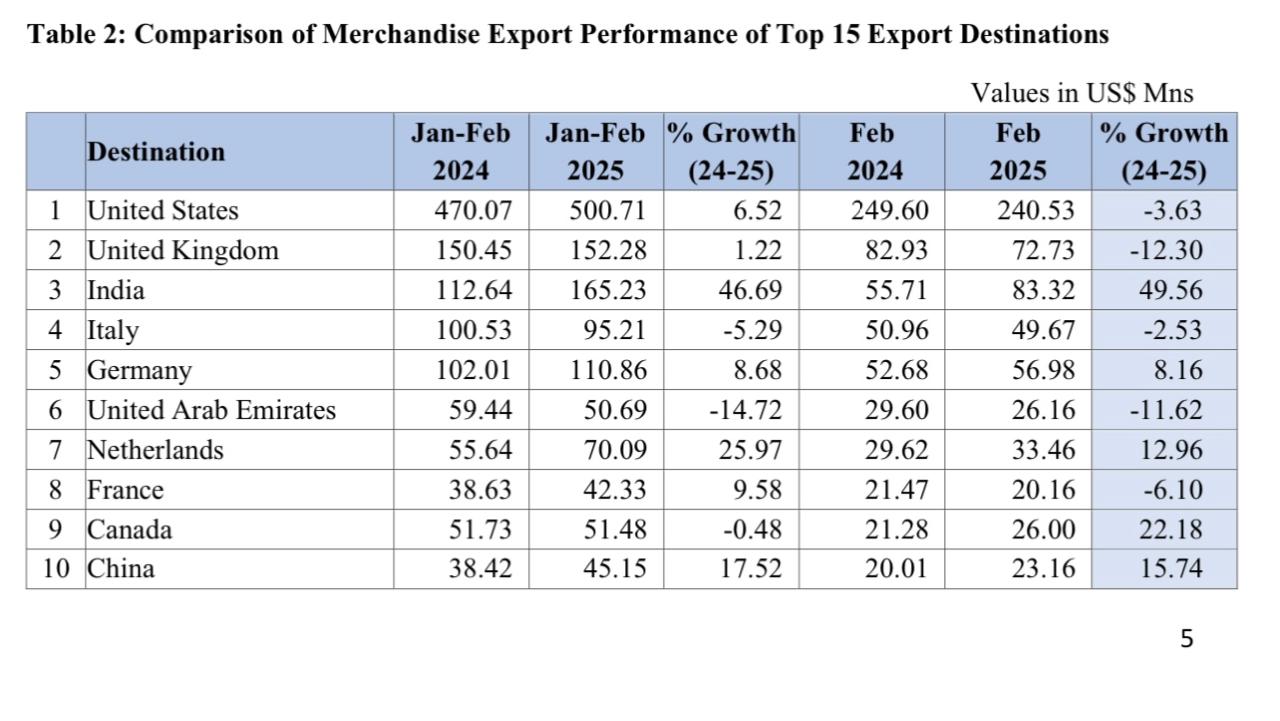

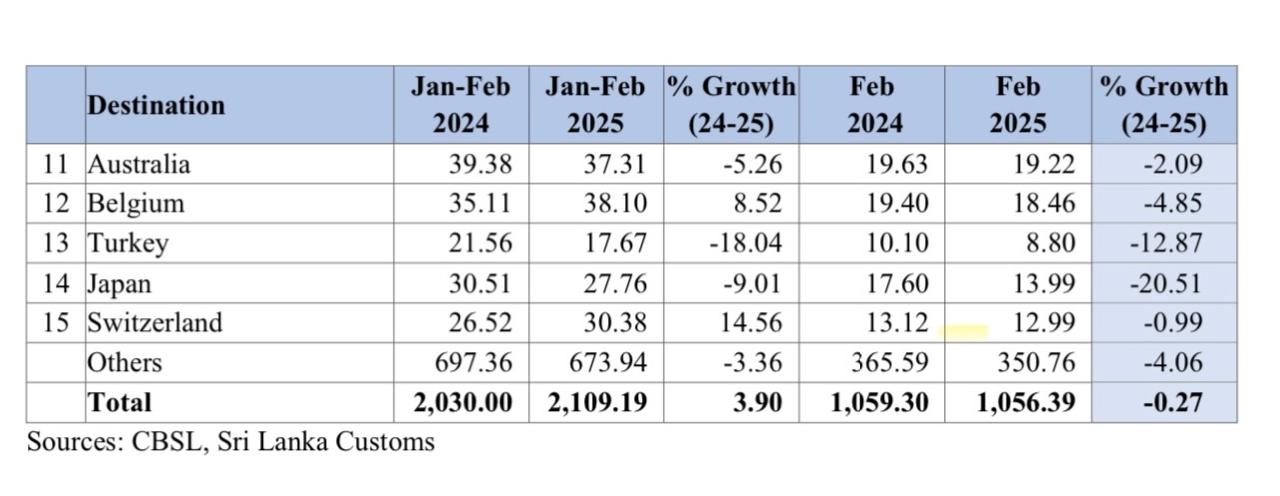

Performance in Key Export Markets

Among the top 15 export markets, India, Germany, the Netherlands, and China recorded positive growth.

• United States (Sri Lanka’s largest export destination):

• February 2025 exports declined by 3.63% to US$ 240.53 million.

• However, January–February exports increased by 6.52%, reaching US$ 500.71 million.

• United Kingdom:

• February exports dropped 12.3% to US$ 72.73 million.

• January–February exports increased 1.22% to US$ 152.28 million.

Exports to Free Trade Agreement (FTA) Partners (India & Pakistan)

• February 2025: Exports to India & Pakistan surged by 44.08% to US$ 88.29 million.

• India: Increased by 49.56%, driven by Petroleum Oil, Animal Feed, and Pepper.

• Pakistan: Declined by 10.77%, mainly due to reduced demand for Textile Articles.

• January–February 2025:

• Exports to India & Pakistan increased by 43.21%, reaching US$ 176.59 million.

Outlook for Sri Lanka’s Export Sector

The continued growth in merchandise and services exports, particularly in ICT, Logistics, Apparel, and Coconut-based products, highlights the resilience of Sri Lanka’s export sector. However, challenges remain in traditional export categories such as Tea, Rubber, and Seafood, necessitating targeted strategies to boost competitiveness in these sectors.